Insuring tomorrow…today

Automated Underwriting, Claims and Distribution

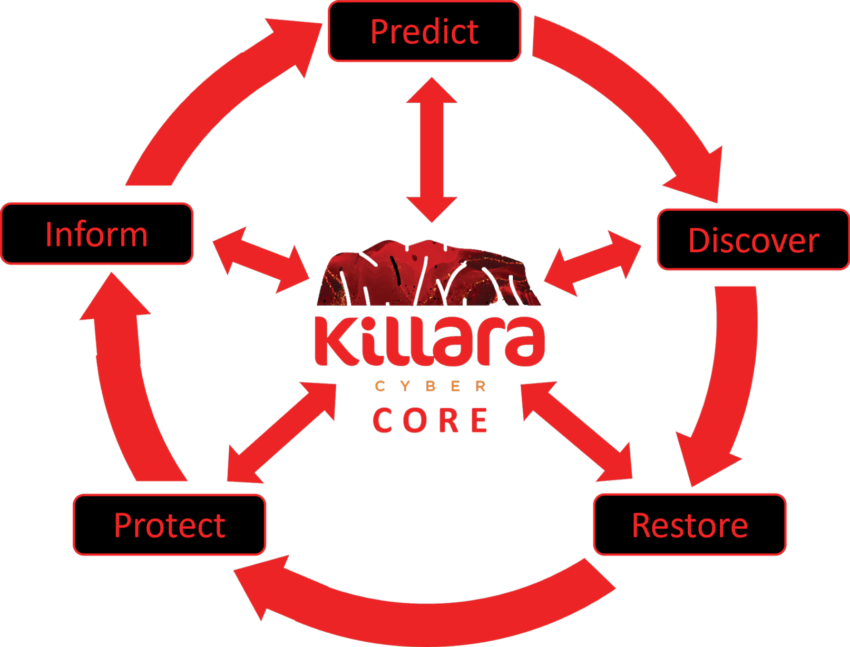

We believe cyber insurance should help identify potential threats, exploits and vulnerabilities – before a cyberattack.

Conquer AI-led and zero-day attacks with our vendor-strength innovations. We bring our technology and data to monitor and protect you from what others cannot. We bring new innovation to insurance products and service to move beyond vulnerability benchmarking, monitoring to better protect against new threats and risks.

We take action against emerging attacks before you are aware you’re even under threat. With our “always-on” global network of industry leading incident responders, we can also identify and disarm known and unknown cyber threats that evade your security, before you are attacked.

URL-only underwriting: no claims warranty or proposal form required

Scan, rate, quote, bind, report and pay – in 90 seconds

Futuristic cyber-all risks coverage – radically simplified

Parametric-style automated triage and claims management

Real-time threat intelligence with over 700 global partners providing continuous and predictive monitoring

Globally-synchronised early detection and prevention providing proactive pre-attack and pre-loss mitigation

Continuous & Predictive Protection, Pre-Loss Remediation

Killara Cyber Industry Coverage

Fully Automated Distribution

Killara innovates our products and services at the pace of the companies we are insuring. Similarly, our distribution partners expect solutions that help them build cost-effective onboarding solutions that eliminate reliance on static proposal forms and data input. To that end, API connectivity is outpacing User Interface applications and broker portals.

Flexible Distribution

Killara’s digital technology allows our distribution partners to bundle and cross-sell cyber insurance direct to clients via API connections. Killara can manage flexible distribution solutions for in-house broker or agency channels, broker portals, white-labelling or embedded insurance.

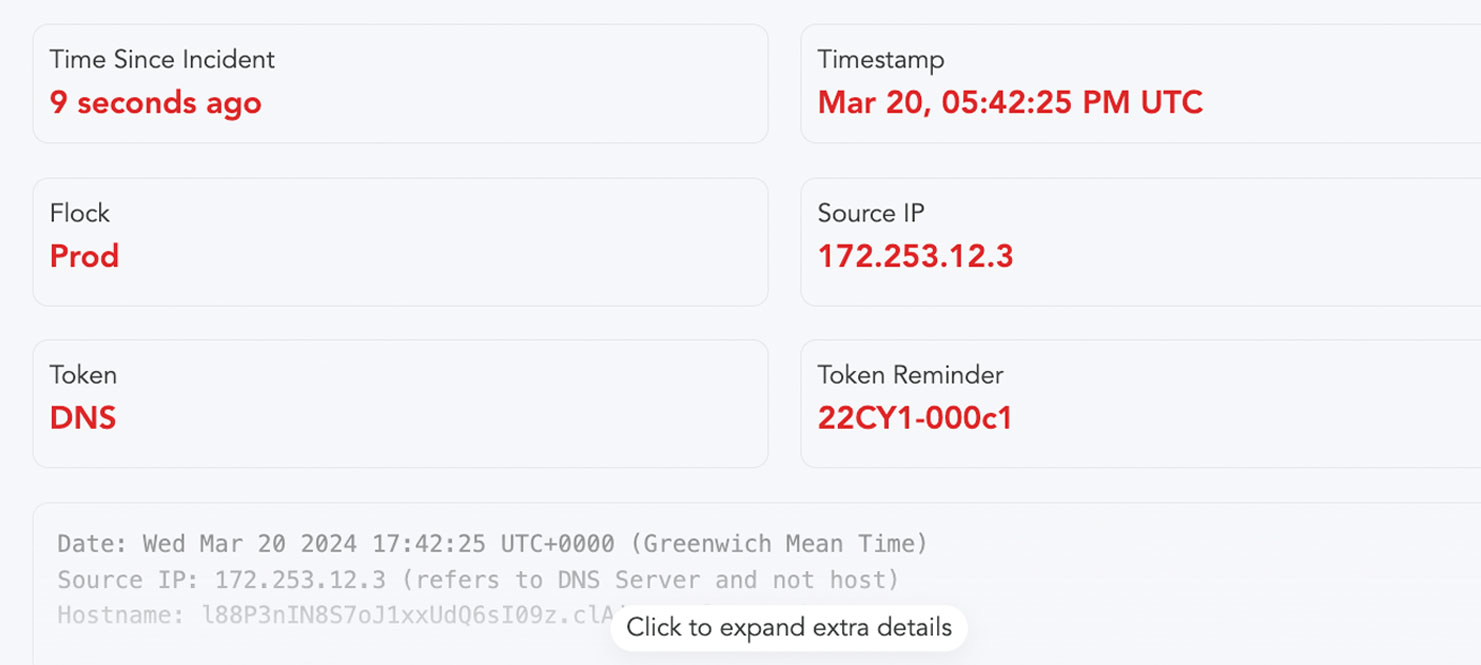

Automated Claims Management:

Early detection embedded in every policy

The purpose of cyber insurance is to detect, prevent and mitigate cyberattacks so that outages from those attacks are minimised. Detection, prevention and mitigation of cyberattacks should also be automated for cyber insurance to be truly effective. Killara’s integrated digital forensic incident response platform provides real-time threat detection, rapid investigation and proactive mitigation and remediation.

Detects anomalous behaviour within the client’s technology estate.

Proactive pre-breach remediation and detection guards against attacks and claims before outages occur.

Stay in the loop

Follow us on Social Media for

behind-the-scenes and more.

Get in touch today

Email us: [email protected]

Address: 5201 Blue Lagoon Drive, Suite 300, Miami, FL 33126